Cash Receipts Journal: Definition, Function, Form, Format, Examples

The cash receipts journal is a special record (journal) that is a place to record cash receipts transactions related to cash receipts, or that cause an increase in cash in a company.

Examples of cash receipts above are cash receipts, transfers from other companies, current accounts or checks, and direct deposits from debtors at the company's bank.

Read more in the review below.

Table of contents

Understanding Cash Receipts Journal

A special cash receipts journal can also be defined as a journal whose function is to record existing financial transactions and can add to the cash balance of a company.

Because in the general journal not all can record transactions related to transactions on credit and also cash and repeatedly, therefore a special journal is needed.

For example: Cash sales transactions, income transactions, accounts receivable settlement transactions, and others that enter the column sundries, as well as transactions for returning goods that have been purchased due to non-compliance (damaged) in cash (purchase returns).

Then it will be recorded in the cash receipts journal as follows:

- When a sales transaction of merchandise is made in cash, it will automatically has an effect on increasing cash balances (debits) and increasing sales balances against (credit).

- At the time of the settlement of accounts receivable transactions, it will also affect the addition of cash balances to (debit) and a reduction in the balance of trade receivables to (credit). If there is a sales discount, it will be recorded by debiting the cash account and selling discounts.

- During the return of merchandise that has been purchased in cash, it will also there is an increase in cash and a reduction in merchandise that has been purchased due to a return goods (returns). The recording that is done is debiting the cash account and crediting the purchase return account for the goods that have been returned.

Cash Receipts Journal Function

A special journal for cash receipts is made by a company with the function as a place to record all cash receipt transactions.

In general, when conducting any transaction, every company will always prepare special evidence or proof of cash inflows except for the cash receipt transaction.

Some transactions that can be recorded in this journal include the following:

- Sales of merchandise for cash

- Receipt of additional capital in the form of cash from the owner of the related company

- Receipt of accounts receivable

- Other income receipts such as rental income made in cash

- Receipt of loans from banks

- Other cash receipts.

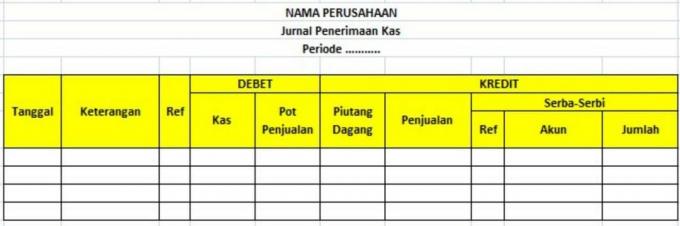

There is no patent form of the cash receipts journal.

But there is a form commonly used by various companies. The form is in the form of columns containing 6 large sections.

The six sections include columns:

- Date

- Proof Number (transaction)

- Description (description)

- Reference

- Debited Account

- Credited Account.

The Debited Account column functions as a place to record the nominal with the debit value.

The debit column is also divided into 2 sub-columns containing the Cash account and Sales Discounts.

Meanwhile, the Credited Account Column functions as a place to record the nominal credit value.

The credit column is also divided into 3 sub-columns, including accounts: Accounts Receivable, Sales, and the Sundries account.

Form

The form of the cash receipts journal itself consists of 6 columns, where each column contains:

1. Date: serves to record the time a transaction took place

2. Description (description): records a description of the ongoing transaction.

3. Transaction proof number: record the transaction proof number. In general, this transaction proof number is in the form of a sales invoice.

4. Reference: provides alerts related to posting transactions in the general ledger.

5. Debited account: records the amount that is debited. The account column that has been debited is also divided into 2 sub-columns, namely the cash account and sales discounts.

- Sales discounts: to record the value of sales discounts given to consumers for ongoing sales transactions.

- Cash account: to record the value of cash that has been received.

6. Credited account: to record the nominal value of the credit.

The credited account column is also broken down into 3 sub-columns, among others: accounts receivable, sales, and sundries accounts.

- Sales: to record the total value of ongoing sales.

- Accounts receivable: to record the value of receivables that have been paid for.

- Sundries account: to record other accounts. The sundries account column is also divided into 2 sub-columns, namely account and amount.

For the account column, it is used as a place to record the types of accounts that are already available. For example: a rental income account if there is a cash receipt of rental income.

For the amount column, it is used as a place to record the nominal value of the related account type.

Format

The following is a general cash receipts journal format:

Example

The following is an example of preparing a cash receipts journal, including:

During April 2014 UD SUBUR JAYA had several transactions related to cash receipts, with data as below:

On April 5, 2014, has received payment of trade receivables from Toko Ayu amounting to Rp2. 500.000.

On April 10, 2014, it has succeeded in selling merchandise in cash at Toko Dwi amounting to Rp2. 300.000.

On April 13, 2014, there was a cash purchase of merchandise from Toko Puji in the amount of IDR 7,500,000.

On April 20, 2014, several items that had been purchased from Toko Puji were returned due to defects with a total value of Rp. 2,400,000.

Transactions that occurred on April 5 are transactions received in the form of settlement of receivables from customers, namely Toko Ayu.

So that the cash balance will increase and the accounts receivable balance will decrease by the same number, namely Rp. 500.000.

Then recorded in cash in the debit position of Rp 2. 500.000. As well as in the accounts receivable column in the credit position an amount of Rp2. 500.000.

The transaction that occurred on April 10 was a sales transaction of merchandise made in cash to Dwi's shop. So that the cash balance will increase and the sales balance will also increase by the same number of Rp. 300.000.

Therefore, it will be recorded in the cash receipts journal, namely cash in the debit position of Rp2. 300,000 as well as sales on credit in the amount of Rp2. 300.000.

The transaction that occurred on April 13 was a purchase of merchandise in cash from Toko Puji in the amount of Rp. 7,500,000.

The transaction is not recorded in the cash receipts journal, because the transaction causes a reduced cash balance (used to purchase merchandise). And it is more appropriate to be recorded in the cash disbursements journal.

The transaction carried out on April 20 was a return transaction for merchandise that had been purchased with cash from the Puji Shop because the condition of the goods was defective.

Transactions like this are also known as purchase returns, the returns that occur are IDR 2,400,000 from a total purchase of IDR 7,500,000.

The purchase return transaction resulted in UD Subur Jaya receiving cash from Toko Puji in the amount of Rp 2,400,000.

Therefore, the transaction will be recorded in the cash receipts journal in the cash debit position of Rp2,400,000. And also in the credit position of the sundries column with a description (account name) of a purchase return of IDR 2,400,000.

Conclusion

A special journal for cash receipts can be defined as a journal whose function is to record existing financial transactions and can add to the cash balance of a company.

Every transaction that causes an increase in the balance of a company will be recorded in a special cash receipts journal. However, if the transaction results in a reduction in the balance, the transaction will be recorded in the cash disbursements journal.

Question

The following are some questions about the Cash Receipts Journal, including:

The cash receipts journal is a special record (journal) that is a place to record cash receipts transactions related to cash receipts, or that cause an increase in cash in a company.

One of them is the sale of merchandise for cash. More in this article.

As a place to record all cash receipt transactions.