Closing Journal: Definition, Purpose, Function, How to Make

Closing Journal: Definition, Purpose, Function, How to Make – In this discussion, we will explain about Closing Journal. Which includes the meaning, purpose and function, how to create and accounts that require closing journals with complete and easy-to-understand discussions.

Table of contents

-

Closing Journal: Definition, Purpose, Function, How to Make

- Definition of Closing Journal

- Purpose and Function of Closing Journal Jurnal

- Accounts Requiring Closing Entries

- How to Make Closing Journal

- Share this:

- Related posts:

Closing Journal: Definition, Purpose, Function, How to Make

For more details, please read the reviews below carefully.

Definition of Closing Journal

Closing journal or in English is Closing Journal Entry, which is a journal published at the end of the accounting period to close temporary nominal accounts. As a result of the closing, the balance of the accounts, will be 0 (zero) at the beginning of the accounting period. Closed accounts are nominal accounts (such as income and expenses) and capital auxiliary accounts (such as prives and summary profit/loss).

After the closing entries are uploaded to each account, what remains is the real estimate (assets, liabilities, capital/equity). Closing journals are made depending on the type/form of the company, whether in the form of PT, CV and Firm as well as individual companies because the capital structure of each type of company is not the same.

Purpose and Function of Closing Journal Jurnal

The purposes and functions of closing journals include:

- Closing balances are in all temporary estimates, bringing those estimates to 0 (zero)

- In order for the capital account balance to provide an overview of the amount in accordance with the conditions at the end of the period, the capital account balance will be the same as the final amount reported on the balance sheet.

- Distinguishing income and expense account transactions so that they are not mixed with the nominal amount of revenues and expenses in the following year.

- Shows the balance sheet at the beginning of the next period after closing the books.

- Makes it easier to carry out inspections, because the transactions that occur between the current period and the next accounting period have been separated.

- Shows real financial information of a company after closing the book (closing journal). Actual accounts are composed of prices, liabilities and equity.

Also Read:Definition of Audit Quality, Measurement and Indicators (Complete)

Accounts Requiring Closing Entries

There are accounts that require closing entries at the end of the period, including:

- Income

- Load

- Overview / Profit/loss balance

- private

How to Make Closing Journal

Closing entries are used to cover several accounts such as income, expenses, profit/loss summary and prive. Below is an example of how to make a closing journal, including:

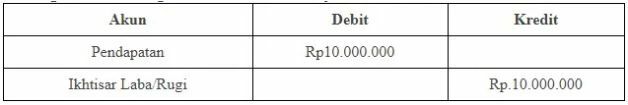

Closing Income Account

Close all income accounts by transferring income accounts to balance/profit/loss accounts. The following is an example of closing a revenue account:

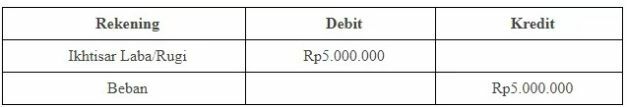

Closing Expense Account

Close all expense accounts by transferring expense accounts to the profit/loss summary. Below is an example of closing an expense account:

Closing Account Profit/Loss Summary

Close all profit/loss summary accounts by transferring the profit/loss summary balance to the capital account. There are two situations that can occur, namely profit (income is greater than expenses) or loss (income is less than expenses). Below is an example of closing a profit/loss summary account.

If a profit is made, the profit/loss summary account is debited and the capital account is credited.

If there is a loss, the capital account is debited and the profit/loss summary is credited.

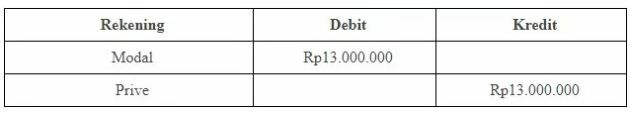

Closing Private Account

Closing a private account (withdrawal of capital by the owner, often only in small companies). The way to make it is to transfer a private account to a capital account. The following is an example of closing a private account:

Thus it has been explained about Closing Journal: Definition, Purpose, Function, How to Make, hopefully can add to your insight and knowledge. Thank you for visiting and don't forget to read other articles.